Perhaps you can still remember the article with the heading "Zeitenwende an den Finanzmärkten", which I had written before the autumn vacations. This was about a possible "thrust reversal" in 2018, by which was meant the monetary policy of the central banks.

Fed pulls liquidity out of the market

To date, the central banks pumped the markets with liquidity as part of the securities purchases to. Now, however, the Fed has started to withdraw money from the market again since the beginning of October. Thus, maturing bonds are no longer fully reinvested, which shortens the central bank's balance sheet. In doing so, it follows this schedule:

This shows the amount up to which maturing bonds and mortgage securities are no longer reinvested. Accordingly, a total of $10 billion has been withdrawn from the market each month since the beginning of October. In the next step it will then be 20 billion from January, etc.

U-turn or expansion in monetary policy after all?

In contrast, the European Central Bank (ECB) announced last week that bond purchases will be extended and continue at least until the end of September 2018. Here the monthly purchases reduce starting from 2018 of up-to-date still 60 billion euro on then 30 billion euro. So money continues to be pumped into the market, although the extent is slowly decreasing.

The question is whether we are therefore now dealing with an expansion of their purchase program or a U-turn? According to a large number of the media, this is the about-face in terms of the ECB's flood of money. However, if the reduction in purchases is a turnaround, it has started much earlier.

Finally, the ECB already took similar measures in December 2016 when it extended the bond-buying program until the end of 2017, reducing monthly purchases from €80 to €60 billion. If one interprets these measures as a U-turn, then their beginning was already in December 2016.

In fact, one could argue quite differently: Since this is an extension of purchases into 2018, it is not a turnaround, but a renewed expansion of the program. Indeed, additional securities totaling €270 billion will now find their way onto the ECB's balance sheet. This brings the total volume of the purchase program to a total of about 2.5 trillion euros. Subsequently, it could then go even further, as purchases will continue "until the Governing Council identifies a sustained correction in inflation developments consistent with its inflation objective". This is the ECB's decision. Depending on the development of inflation, a renewal is therefore possible.

It is therefore not surprising that both stock and bond prices have been trending higher recently. Because bonds continue to be in demand directly and stocks indirectly due to the ongoing flood of money.

The flood of money will dry up in 2018

However, it is important to remember that demand will fall by half from 2018. In fact, as of April 2018, no additional liquidity will be injected into the market at all, if you only look at the central banks ECB and Fed. That's because the Federal Reserve will stop reinvesting securities worth $30 billion a month starting in April, while the ECB will continue to issue the same amount at the same time. What the ECB gives will be taken away again by the Fed to the same extent. The result is a zero-sum game (which is only moved a little in one direction or the other by the exchange rate).

As future developments are also priced into the markets, the fact that no additional money will be made available by the ECB and Fed from April 2018, or at the latest from July 2018 depending on exchange rate developments, could weigh on prices early on. A pause of the upward trends on the stock markets is therefore possible in my opinion.

In the same way, we have a major sideways movement, which does not even necessarily have to take place above the current price level. The range in the DAX could also be between 12.000 to 13.500 points lie. At the same time, the current sideways movement in the Bund future could lower to a lower level. When it is so far, however, is the crucial question.

Panic is never appropriate!

A short time ago a reader accused me of spreading panic for weeks already. I can hardly deny my amazement at this. But it demonstrates how differently you can obviously read texts. But it is admittedly also somewhat complicated. On the one hand, I warn of overheating in the U.S., rightly so. On the other hand, I have been pointing out for months that one should follow the intact upward trends and by no means bet on falling share prices already now. Especially since I have repeatedly reported on the solid economic data from which the rising corporate profits resulted. This in turn fundamentally supported the uptrends on the stock markets.

At the same time, however – especially in your interest, dear readers – I cannot simply ignore the risks that are increasing in the meantime! On the contrary! I deliberately want to address them openly. These are, among other things, the overripe trends and the now high fundamental valuation of the U.S. indices. My assessment that one should avoid U.S. equities and prefer European securities instead does not sound like scaremongering to me.

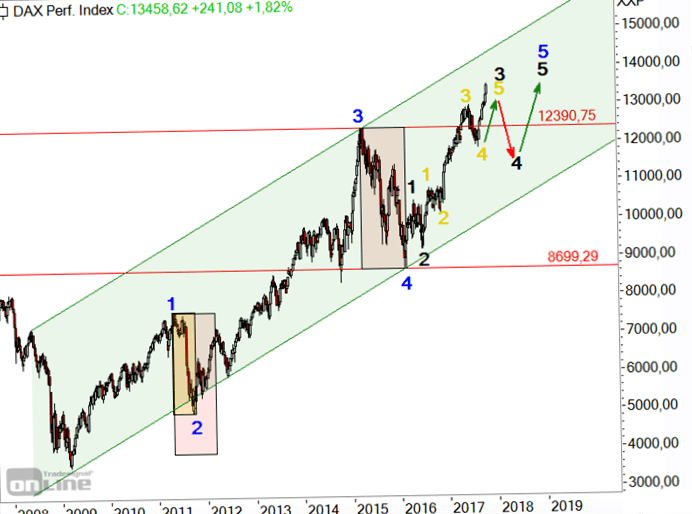

In terms of the chart, there has also been no reason to fall into fear in my analyses so far. After all, the Elliott wave chart from Börse-Intern from 5. October, for example, only that the upward trend in the DAX that began at the start of 2016 is in its final wave and that I expect a correction in the near future, but that this will be followed by new all-time highs. Even with a correction of 10% we would not have to deal with a trend reversal or even a crash.

Looking back at the fundamental (over)valuation of U.S. equities (see yesterday's chart from FactSet), such a correction would merely bring the markets back to a healthy level. From this point, profit growth and share price increases could then continue.

Fittingly, I would like to conclude with my text from 12. October remember. In this one, I even explicitly warn against panic-like reactions, should there ever be relatively sharp price setbacks. The tips of that time have not yet lost their meaning. So you should continue to take them to heart so you don't run into problems in the event of a potential correction.

In summary, neither panic nor greed are good stock market advisors. The only way to be successful in the long run is to maintain a healthy and detached composure.