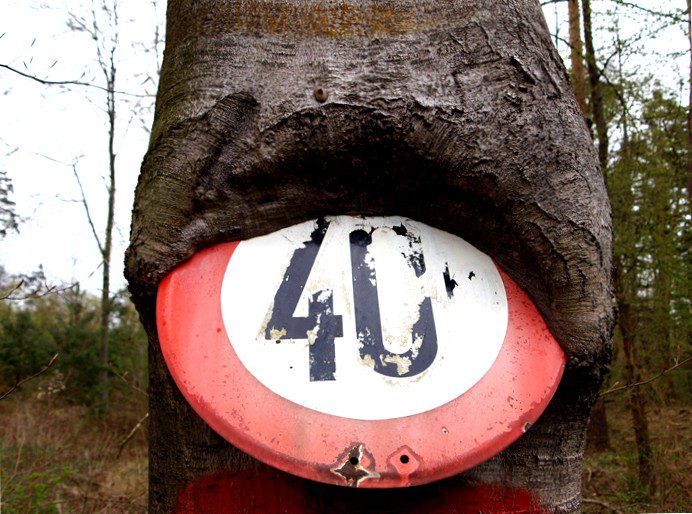

You as readers of this blog have always heard one thing from us so far: In times of low interest rates, a long fixed interest rate is always desirable to create some security for yourself. However, Allianz now offers a financing model that may overstate this approach a bit. We are talking about a fixed interest rate of 40 years.

40 years – that is truly a long fixed-interest period

"Favorable interest rates for up to 40 years: With fixed interest rates of 5 – 40 years (…) you can secure the current low interest rate level. That is, without the risk of an increase in interest rates and with room for financial security." (see: Allianz) This is how Allianz touts its latest construction financing for extra-long fixed interest rates. But for whom is such a concept worthwhile? Theoretically, a long fixed interest rate is exactly what Zinsvergleich advocates in the low interest rate phase, but in our opinion 40 years is excessive.

The conditions are not optimal

Long fixed interest rate at the same time means higher interest rates in general. With a commitment of 5 years you always get the most favorable interest rates, because here is the greatest risk that afterwards a more expensive follow-up financing is pending and not much of the actual loan has been repaid yet. In the case of the Allianz model with a 40-year fixed interest rate, a loan-to-value ratio of 80% and a repayment rate of 1.23%, the borrower will have to pay a full 3.21% as a borrowing rate in August. If, on the other hand, you look for a construction financing with only 10 years fixed interest and otherwise similar conditions, you can perceive a debit interest rate that is just half as high.

Purely theoretically, you can really save money with this financing model, but only if in 10 years the interest rates for a follow-up financing would be above 5%. However, this is very unlikely. At the end of 2005, a good 10 years ago, the interest rate was ca. 3,8%. Interest rates would have to rise more in the next decade than they have fallen in the past decade. What's more, a repayment rate of just 1.23% is far too low. With such a low repayment, you really need the 40 years to become debt-free.

Conclusion

A long fixed interest rate is currently quite desirable. However, 40 years with a repayment of not even 1.5% is far too little. There may well be groups of people who are willing to pay more for such planning security, but they are unlikely to save money.

Our tip: Get professional advice. Choose rather a not so long fixed interest rate, rather 15 – 20 years and use the saved debit interest for a higher repayment. Thus you are faster again debt free. In our opinion, it is unlikely that interest rates will rise above 5% in the next 10 years, which makes the long fixed-interest period of 40 years not exactly profitable.